|

10/31/2016 Financial Recovery from Abuse: Taking Control of Your Life by Taking Control of Your FinancesBy Christine Murray, See the Triumph Co-Founder

All this month, our focus at See the Triumph for Domestic Violence Awareness Month has been on the financial impacts of intimate partner violence for victims and survivors. As we’ve discussed throughout the month, the financial costs of abuse are often substantial, and these can add a lot of challenges and complexity to the recovery process in the aftermath of an abusive relationship. Whether these financial impacts come in the form of impaired career advancement, legal costs in family court, and/or the costs of physical or mental health care, the toll on survivors can be huge, especially as they work to rebuild their financial lives while also working on their physical and emotional recovery. All of these financial challenges can be overwhelming. However, overcoming them is possible. As we wrap up our Financial Recovery series today, today’s blog post will offer some suggestions for survivors of abuse to use to take control of their finances, and ultimately to take control back over their lives. If you or someone you know is struggling with financial challenges as part of the process of recovering from abuse, consider the following strategies: 1. First, be patient and gentle with yourself. You may feel overwhelmed and afraid by the financial challenges you face. Depending on the extent to which your abuser financially abused you, the financial toll of the abuse may indeed be major. If this feels like an overwhelming issue to address, reassure yourself that recovery will take some time, but it is possible. Consider writing affirming messages to yourself in a place where you’ll look at them often. Whenever you feel overwhelmed, practice self-care and use your coping strategies to manage the stress in healthy ways. 2. Take stock of your overall financial picture and the financial impacts of abuse. Although it may be tempting to put off or avoid looking at your financial situation, you can only begin to plan how to address it once you’ve done a thorough assessment of where your finances stand today. Set aside time when you can spend a few hours to list all of your accounts, assets, debts, potential future expenses, and any other financial details of your life currently. As best you can, try to organize this information without worrying about it. It may help if you think about your financial situation like a business, and you are the manager. Take your time to really understand your financial starting point, so you’ll have a clear picture of where things stand today. 3. Think of one small change you could make in the near future to begin to improve your financial situation. Before you start dreaming big about your financial future, it’s a good idea to set yourself up for some small successes along the way. Once you’ve taken stock of your financial picture, try to identify one small change you could make to begin taking control of your finances. For example, perhaps you have a small debt that you could pay off with your next paycheck. Or, maybe you could start using a written budget to help organize your income and expenses for the month. By starting to focus on small, realistic financial goals that you can accomplish quickly, you’ll begin to notice a change in how you feel when you realize that you can take control of your finances. You may not be able to change everything overnight, but at this stage, it’s more important to simply start building momentum and feeling like you have more control over your finances. 4. Start dreaming big about your financial and career future. Once you’ve started gaining a little momentum for improving your finances, it’s time to step back and think about what your ideal vision for our economic future would look like. Do you have any goals or dreams for your career or education that you had to put on hold due to your abuser’s control of you? If you think of your life when you reach retirement age, what impact would you liked to have made on the world around you? What financial goals do you have for yourself? Perhaps you dream of owning your own home or taking your children on a nice vacation. Give yourself time to think through what you’d like for your future life and career. This may be a very difficult step, especially if your abuser told you things like, “You can’t do anything right,” or “You’ll never be successful.” Acknowledge that these statements have impacted you in the past, but remind yourself that they don’t have to define your future. Trust that you have unique skills, talents, and contributions to offer the world, and allow yourself the time and opportunity to figure out how you’d like to make that impact. 5. Map out a plan to get from your starting point to your vision for your financial and career future. Once you’ve dreamed big about what your life could be, it’s time to start working on a plan to get you from where you are now to where you want your life to go. This stage might involve adjusting your dreams to make them more feasible. For example, in your big dreams, you may have wished you could become a doctor. Although you know you’re smart enough for that path, you may decide that you want to find a career path that will not require as long of a schooling process, so you begin exploring other career paths in the medical field. This stage also should involve doing some research to understand the steps that you’ll need to take as you move toward your career and financial goals. You may find it useful to start using a specific financial planning process, such as the 7 Baby Steps proposed by financial guru, Dave Ramsey. If it’s a career goal you’re exploring, this research might involve talking to professionals already working in that field or learning about relevant educational programs. As much as possible, map out a very specific set of steps you’ll need to take to move toward your financial and career goals. The more concrete steps that you identify, the more you’ll be able to track your progress along the way. 6. Build a strong network of supportive people and resources. You don’t have to go through this journey on your own. Surround yourself with people who you can depend on to encourage and support you along the way. If there are people in your life who can’t or won’t support you in your goals, set boundaries with these people to limit their impact on you. Instead, focus your time and energy on connecting with others who will be there for you and will cheer you on as you reach your goals, and even when you face setbacks along the way. In addition, connect with resources that can help support you in achieving your goals. This could be a career counselor, a financial advisor, a community agency, and credible online resources for financial information. These positive sources of support will be invaluable to you on your journey toward financial recovery. Financial recovery from abuse can be a long, complicated process. In many ways, your financial recovery is closely linked to other aspects of recovery, such as your emotional recovery and your process of reconnecting with a support network. One of the greatest aspects of financial recovery is that it offers tangible opportunities for you to feel success. Other aspects of recovery can feel a lot more fuzzy than financial recovery. It can be harder to track your emotional recovery process than it is to track the numbers involved in your financial recovery process. In that way, financial recovery offers tangible successes that can help to increase your confidence in yourself. Each big and small financial goal you achieve offers you a chance to feel successful and empowered by the control you are taking back from your abuser. By taking control over your finances and believing that you can work toward positive goals for your life and your money, you have the chance to rewrite the script for your future. This process may be difficult, but it is well worth it! 10/27/2016 Rebuilding Your Life After AbuseBy Christine Murray, See the Triumph Co-Founder

You’ve left the abuse behind. You’re determined not to go back. You’ve realized that you deserve more than an unsafe, abusive partner who controls and demeans you. You deserve better--a happy, fulfilling life in which you can make a positive difference in the world. You know, deep down, that great things are in store for you, even if you can’t fully picture what that will look like or how you will get there. You’re ready to step boldly into your new life, free from abuse. But first, there may be some messes that you need to “clean up” in the process of moving on from your abusive partner. Your finances may be limited--or even non-existent. Your abuser may have blocked you from going for your educational or career goals, and you’re frustrated when you think of where you could be or should be if you hadn’t fell prey to that person’s controlling tactics. Today, I want to encourage you. You can do this! You are not alone on the challenges you’ve faced. We’ve heard from hundreds of survivors of abusive relationships through our See the Triumph research program. Time and again, we’ve seen that recovery, accomplishment, and triumph are possible in the aftermath of abuse. It’s true that the path to this new life may be more complicated for you now, but you showed your strength surviving in and leaving the abusive relationship, and that same strength will be your inner guide as you rebuild your life and career after abuse. At See the Triumph, we’ve heard from many survivors that the abuse they experienced left them feeling disappointed by all that their abusers had taken from them, emotionally, financially, and in terms of lost opportunities. As one survivor told us, “I am completely behind the rest of the world because I have had to spend so much time dealing with an abuser.” Rebuilding after abuse may involve starting over completely, from scratch. Safety risks may persist, as abusers can continue to use their abusive tactics even after the relationship ended. As another survivor said, “I had to move twice running from him. People don’t understand how afraid you can be. Others only judge and don’t help. And yet, what we’ve seen in survivors is a fierce determination and tenacity to move forward, by doing whatever it takes. Consider the following quote from a survivor in our research: “I am over $100,000 in debt (living off student loans and credit cards), all while working four jobs and going to grad school to try to get my life back in order.” Although it is unfortunate that this survivor is incurring more debt during the process of rebuilding, we can only stand in awe of her commitment and dedication to bettering her life--working four jobs is no easy feat, and then she added graduate school on top of that. This survivor, like many others we’ve heard from, shows just how determined people can be when they put their mind to it and commit to building a safe, fulfilling life in the aftermath of abuse. In many cases, there are no easy solutions to rebuilding your life following abuse. Of course, there are strategies that can help this process, such as (1) surrounding yourself with as much positive, encouraging social support as you can find, (2) mapping out a vision for what you would like your future life to be like, (3) developing a plan for how to get your life from your starting point now to making that vision a reality, (4) setting meaningful, realistic goals to help you track your progress along the way, and (5) practicing intentional self-care so you can cope with the frustrations and challenges that arise. It may be tempting at times to wish you could simply wave a magic wand to completely erase the past and fast forward to a future time when your life feels more stable and “rebuilt.” At times, it is a good idea to simply notice and appreciate those feelings and allow yourself to feel the emotions that arise with this tempting wish. However, I also encourage you to remember to appreciate the beauty in the struggle of rebuilding your life following abuse. You will find strengths in yourself that you might never have known existed as you face each challenge, one-by-one, and see that you can overcome this. You can leave the past behind, but still benefit from the powerful person it has made you today. You can move forward toward building a life that reflects the unique person that you are and the positive impacts that you can have on the world and people around you. With each challenge you face in the process of rebuilding your life after abuse, rest in the confidence of knowing that this process offers you opportunities to learn about yourself, identify people in your life who are tried-and-true supporters, and tap into the depths of your strength and courage. You are worth it. By Christine Murray, See the Triumph Co-Founder

Abuse is wrong. At See the Triumph, we believe firmly that there is no place for abuse in our society and especially in healthy relationships. We also believe that people who perpetrate abuse should be held fully accountable for their actions and the consequences of them. Unfortunately, however, all too often it is the survivors of the abuse who end up paying the price for their abusers’ actions. Consider the following statements made by participants in our research: “It upsets me that I have to pay for what other people have done to me.” “I have to pay financially, mentally, physically, emotionally, and spiritually for the cruelty of others.” If abuse is wrong in the first place, how much more insult is added to injury when victims and survivors of abuse are forced to pay the extensive costs that often are involved in their recovery process. These costs can come in many forms: counseling and medical bills, legal fees for quality representation in criminal and family court, lost income due to missed work during and after the relationship, and replacing items destroyed or lost in the process of leaving the relationships, to name just a few. In a small number of actual cases, survivors may have access to victim’s compensation funds to help offset some of these costs. However, we’ve heard from many survivors in our See the Triumph research studies that they were left to bear the burden of the financial costs of the abuse on their own. This becomes even more challenging when their abusers had limited their work and educational options as a form of control in the relationship. Together, we must continue to develop solutions to ensure that abusers are held accountable for bearing the full responsibility for their abuse and its consequences, and this includes the financial costs for survivors. When abusers refuse or are unable to pay the price, community resources should do all they can to help support survivors in covering these financial costs and keeping services free or low-cost. Victims do not choose to be abused--their abusers choose to act in violent, abusive ways. Let’s keep working to ensure that victims and survivors do not have to pay the price for the actions of others who have already attempted to hurt them in so many other ways. 10/18/2016 It's Not Just a Hit That They CommitBy Alyssa Triolo and Haleigh Scherma, See the Triumph Guest Bloggers

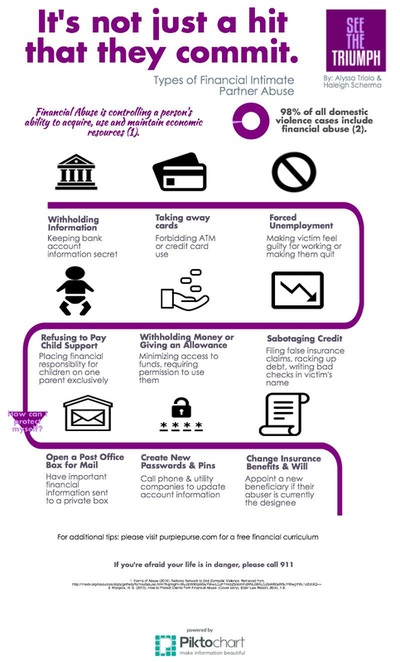

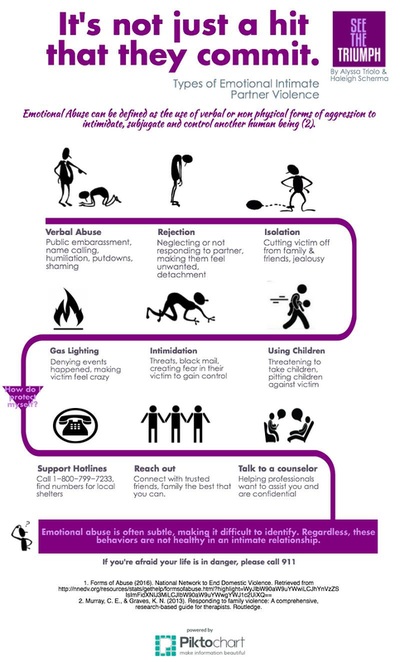

While there are plenty of instances of domestic violence on the news and in the media, the cases that capture the headlines often don’t reflect many of the realities that victims of abuse face daily. What comes to mind when we say domestic violence or spousal abuse? Black eyes? Bloody lips? Maybe even some bruises? Certainly, these are included in the definition of an abusive relationship and are among the most visible signs of danger, but there are far more examples of abuse that are overlooked, often because they are less visible to the outside world. While statistics differ from study to study, about 25% of women in the United States have experienced domestic physical abuse, but that number is minute compared to the many more that have been victims of emotional and/or financial abuse (FTI Consulting, 2014). Part of the reason these two types of abuse have fallen under the radar is due to how subtle they can be. Emotional abuse is defined as the use of verbal or nonphysical forms of aggression to intimidate, subjugate, and control another human being (Jacobson & Gottman, 1998, p. 148). It can appear in many forms, from name calling to intimidation or even an inconspicuous threatening glare. Part of the reason this type of abuse is so damaging is due to the fact it has long-lasting effects on a victim’s self-esteem. When working with clients who have experienced intimate partner violence, we’ve noticed that they often say the same thing: the physical bruises healed, but the words still hurt. Financial abuse is controlling a person’s ability to acquire, use, and maintain economic resources (Tisdale, 2016). It is extremely common in intimate partner violence relationships, far surpassing the prevalence of physical violence. However, the vast majority of the population, 75%, do not connect financial abuse with intimate partner violence. In fact, nearly 98% of those who have experienced domestic violence have also been victims of financial abuse (Margolis, 2015). Financial abuse fosters dependence on the abuser. Some of the more obvious forms are controlling finances, withholding account information, preventing victims from holding a job or taking away ATM cards, giving their victims an allowance, or even stealing their identities and ruining credit by filing false claims and racking up credit card debt. The effects of financial abuse can be detrimental to the recovery process after leaving the relationship. One study found that, on average, people lose $30,000 from financial abuse, and 10% of victims lost more than $100,000 (Margolis, 2015). Just because emotional and financial abuse can’t be seen overtly does not mean they don’t warrant our attention. Around 58% of Americans believe that the news media and entertainment industry have a responsibility to shed light on domestic violence, yet around 3 in 4 people believe they are not discussing it enough and are inaccurately portraying it (FTI Consulting, 2014). So, what can we do? How can we protect ourselves and our loved ones from abuse like this? How do we help friends and neighbors who are struggling with emotional and/or financial abuse? If you suspect a friend or loved one might be experiencing financial or emotional abuse, there are ways you can help. One of the most important things you can do is be a source of nonjudgmental support for them. It’s okay to express your concern for their safety. However, it’s important to avoid pressuring them to take your help. Remember, they have been coping with this struggle for this long, and they are the expert in their own lives. Asking how you can help is better than taking charge and falling into the same power dynamics of someone else controlling their life. More tips and information can be found through the Allstate Purple Purse Foundation and the National Network to End Domestic Violence. Even if a victim does not feel ready to take action, just knowing that what they are experiencing is abuse can be validating and may plant a seed for change. Alyssa Triolo received her Master’s degree in Counseling with a specialty in Couple and Family Counseling from the University of North Carolina at Greensboro. She has worked for the past year with women who are domestic violence survivors and women who were living in a domestic violence shelter. She is currently pursuing her license as a Professional Counselor with the hope of working with clients on improving their mental health and wellness. Haleigh Scherma is an alumna of The University of North Carolina at Greensboro's Couple and Family Counseling Program where she interned as a sex therapist for couples and individuals struggling with intimacy and relationship issues. Currently, she is employed as a couples counselor, sex and intimacy therapist at Thrive Couples and Family Counseling Services in Denver, CO. References

By Lavender Williams, See the Triumph Guest Blogger Domestic Violence can have lasting effects of all kinds, including physical, emotional, social, and cognitive. One consequence that is often forgotten is the financial cost of abuse for victims and survivors. Financial abuse is a form of domestic violence. Abusers can exert control over their partners by forbidding them to work, taking their paychecks if they are employed, and harassing them at work. In this blog post, I’ll describe two additional financial abuse tactics: withholding child support payments and credit fraud. I’ll also describe steps that can be taken after leaving an abusive relationship to combat these. After survivors decide to leave their abusers and safety is established, physical wounds may heal, and survivors can regain control over their own bodies. However, many of the financial effects of abuse last longer than physical injuries from abuse. When survivors have left their partners, they may be left with no money, no job, and perhaps even without a home. In many cases, these factors contribute to the reasons that people stay in abusive relationships for so long. After leaving abusive relationships, many survivors try their hardest to erase their abuser from their lives all together, but one way that many survivors remain connected to their abusers is through their children. Oftentimes, an abuser is required to pay child support or spousal support after a divorce or separation, and the abuser may see this as an opportunity to maintain control after the relationship has ended. Abusers may recognize that survivors and their children are dependent upon that income and choose to withhold payments, despite the legal repercussions. This can leave survivors struggling to make ends meet, especially if they are unemployed. If the former partners are in the middle of a divorce, the abuser may attempt to hide assets in order to reduce spousal support payments. These tactics are important to keep in mind after separation in order to be better educated on how to use lawyers and government resources to regain financial security and hold abusers accountable. Another form of financial abuse is credit fraud. While together or even after separating, abusers may open credit card accounts in the victim’s name, without permission. This could be considered identity theft and credit card fraud in some cases. One way to combat this is to keep personal information hidden either in the home or outside of the home with a safe person. Another option is to contact credit companies and dispute the charges. Many companies will be willing to work with individuals to remove charges and identify the responsible parties, especially if you choose to file charges against the credit thief, in this case the abuser. Withholding child support and committing credit card fraud are just two of the tactics that abusers may use to interfere with survivors’ financial well-being. By understanding these tactics, reaching out for social, legal, and financial support, and taking proactive steps to recover, survivors can regain control of their economic independence as they move toward recovery from past abuse.  Lavender Williams received her Bachelors of Science degree in Psychology from Lynchburg College in 2015. She is currently beginning her second year as a Masters student in the Couples/Family Counseling program at the University of North Carolina at Greensboro. 10/11/2016 Taking Back Your Financial IndependenceBy LaQueta Bartley, See the Triumph Guest Blogger

Financial abuse is a type of abuse that does not often come to mind when someone thinks of domestic violence. An abuser’s main purpose through financial abuse is to create an environment in which the victim has to be dependent on the abuser. This type of abuse prevents victims from acquiring, using, or maintaining financial resources. How do you know if you’ve been abused financially? Some examples of financial abuse include, but are not limited to, preventing one’s partner from working; withholding money; controlling how money is spent; forcing victims to write bad checks or commit fraud; running up large amounts of debt on joint accounts; refusing to work; hiding assets; and withholding funds for the victim or children to obtain things they need to live. If you’ve experienced financial abuse, below are some important things to consider that can help to gain back your financial independence in the process of leaving an abusive partner. While reading these tips, keep in mind that everyone may not need every tip that is listed. Everyone has their own journey and should consider the safest, most relevant steps to take in their own situation.

Recovering from financial abuse can take a lot of time and energy. However, recovery is possible, and you can take steps to regain your financial independence. Take it a step at a time, and soon you’ll find yourself on the path toward building financial freedom. Resources for more information: 10/10/2016 College Relationships and Financial AbuseBy Sara Forcella, See the Triumph Contributor

Financial abuse is one form of abuse that is rarely talked about and is less understood than other types of abuse. This especially holds true for the college population. Financial abuse occurs when one partner uses abuse tactics to maintain power and control over their partner. Some pretty common forms of financial abuse include things such as controlling where and when your partner takes a job, not allowing your partner to work, not allowing your partner to have control over their own income, or hiding or keeping money from your partner. Students who find themselves in financially abusive relationships during college may be dealing with some similar, yet specific forms of this abuse. Many students rely on financial aid to not only help them pay for classes, but afford things like meals, toiletries, and clothing. Financial aid monetary funds can be used to easily maintain power over a partner. Stealing a partner’s financial aid check, or limiting what they are allowed to use that financial aid on is certainly a form of abuse. Partners may also use their financial aid package as a way to ensure that their partner does not leave the relationship. Things like student ID’s make it easy for abusers to purchase food and other items using their partner's money. They may also use ID cards as a way to monitor and dictate the amount of money that their partner is able to use. For instance, an abuser may maintain control over a student’s access to their online ID Card account, giving them the ability to add money to that card when they chose. Students from varying backgrounds may also face financial abuse if their partners use their own financial privilege over their partner. Making your partner feel bad because they are unable to afford things such as off-campus meals, weekend getaways, and athletic games can also be a form of abuse. Just like physical or emotional abuse, abuse is abuse, and it is never okay. Students who are dealing with financial abuse may consider reaching out to an on-campus office for help, such as a Women’s Center, Counseling Center, Campus Police, or the Office of Student Conduct. 10/7/2016 Infographic: 5 Signs of Financial Abuse10/6/2016 The Subtleties of Financial AbuseBy An Anonymous Guest Blogger

“Babe, would you like to use my credit card for that?” These were the words that constantly left my mouth during my previous relationship with my abuser. It’s quite interesting the way I first learned about credit cards…actually, my abuser, the person who constantly worried about my financial position, particularly in terms of acquiring debt while I was in college, suggested that I apply for a credit card in order to make a large purchase for him. At the time, I was still relatively naïve, being an older teenager in college, but I knew that his family lacked the financial resources he truly needed to be a successful student. Since I constantly wanted him to be happy, I obliged to his request. The understanding we had was that he would pay me back immediately after he received his refund check for school in order to pay off the debt, approximately $1500 or so if I remember correctly, which he did. However, in the months and years to come after this initial purchase, I would find myself using my own financial resources to continue keeping him happy, even if he never directly asked me to. To provide a little more detail, I don’t recall many times after his initial request that my abuser directly asked me to cover various expenses. However, given the power and control dynamics of our relationship, I was constantly striving to keep him happy…whether that was through purchasing gifts for him that I thought he would like, covering meals and trips, paying his cell phone bill, and even making purchases that we discussed he would eventually pay back. I found that I was attempting to please someone that could never be pleased. I remember one specific time where I spent nearly $500 for a special Valentine’s Day outing on a small yacht in the city where I lived at the time towards the end of our relationship. Despite the nearly perfect date and the most romantic time we had shared in a while, the day still resulted in a violent altercation by the end of the night, evidently because I made him “feel stupid” at some point on our way home. Sometimes I still get angry with myself for all of the things I did for him financially – paying his bills, buying him gifts, and covering larger expenses that I thought he would eventually back me back for. When I think back to my intention in risking my own financial position as a young adult who had just graduated from college at the time, all I can think about is the subtle way that my abuser would manipulate me into financially abusive situations knowing that I could not truly afford to do so. I also believe he consciously knew that he would never repay me or contribute to the relationship financially in any way as long as I “volunteered” to cover everything. Needless to say, I was never reimbursed for the debt I accumulated through my credit card purchases I made for him either during or after I left the relationship. Ultimately, it took nearly 2 years for me to pay off my outstanding credit card debt, which mostly consisted of larger purchases I had made for him over the years I presumed he would help me pay back. While this was a discouraging process to go through, I have to stop myself sometimes and remember to not blame myself for past actions given the power and control dynamics that were at play. To current victims and survivors of financial abuse with an intimate partner or other trusted individual – be gentle on yourself and on your heart when thinking about these issues. Remember that no one deserves to be abused in any form or fashion. It is possible to seek help and recover from the aftermath of an abusive relationship from a financial standpoint. Despite the grim outlook at first, with confidence, discipline, support, and self-compassion, one can overcome the aftermath of financial abuse. By Kelly King, See the Triumph Guest Blogger An important, often overlooked, area for survivors in recovery can be their financial situation. Finances can be important to consider since they might determine access to resources (such as medical appointments or child care) and relate to feelings of empowerment and self-reliance. Researchers with connections to the See the Triumph campaign set out to listen to and reflect the experiences of survivors of IPV in terms of their finances. Survivors in our study estimated their costs for physical health care (visits to doctors, filling prescriptions, etc.) with an average of $13,990.68, an average of $8,662.64 for mental health care (meeting with counselors, psychiatrists, etc.) and $3,408.33 for cognitive health care (testing, etc.). Survivors also described their experiences of these costs, financial abuse and the challenges of rebuilding their lives. This blog post describes some of their observations and might suggest areas to consider as you pursue financial well-being. Many survivors noted work-related difficulties, including trouble finding or keeping jobs. For some people, this trouble was related to their abusive partner’s pattern of controlling their ability to work. For others, working was difficult because they were also managing health care appointments, dealing with mental or physical health symptoms, attending court dates, finding affordable childcare and concerned for their safety. Difficulty with work can mean that you do not feel financially independent and secure. Working can also be an important way to feel empowered and active for people who are able to choose jobs that fit their personal strengths. Costs from legal fees, childcare, health care and debt/bankruptcy were other burdens that survivors in our study discussed. Many people described feeling overwhelmed by the costs and identified whether they were able to cover these costs or if they turned to government assistance or help from their social circles. Unfortunately, 74.4% of survivors indicated that they did not access victim’s compensation (reimbursement for legal, physical, mental, and/or cognitive costs). This might be an option for survivors facing large costs, and varies by state and community. In addition, survivors highlighted the quality of life costs that come up in the aftermath of abuse. Whether survivors are dealing with physical injuries, or feelings of anxiety or depression, these symptoms lower their ability to enjoy life or feel secure. Some survivors expressed concern that this would never change whereas others noted some positive developments as more time passed and they continued to rebuild their lives- seeking counseling, support from friends and family, and getting involved in new lines of work and hobbies. Survivors demonstrated the many ways that IPV can impact your financial situation. It is our hope that this information might help to show you that it is normal to deal with financial difficulties following IPV. You are not alone in this struggle and there are resources! If you are in need of resources in this area, you might begin your search at http://www.clicktoempower.org/.  Kelly King, MS, NCC, LPCA is a doctoral student in UNC Greensboro’s department of Counseling and Educational Development. Kelly has a background and interest in feminist theory and Women and Gender Studies. Kelly has completed research and advocacy projects related to teen dating violence, survivors of IPV as social justice advocates and the financial impacts of IPV. |

Archives

July 2024

CategoriesAll About Intimate Partner Violence About Intimate Partner Violence Advocacy Ambassadors Children Churches College Campuses Cultural Issues Domestic Violence Awareness Month Financial Recovery How To Help A Friend Human Rights Human-rights Immigrants International Media Overcoming Past Abuse Overcoming-past-abuse Parenting Prevention Resources For Survivors Safe Relationships Following Abuse Schools Selfcare Self-care Sexual Assault Sexuality Social Justice Social-justice Stigma Supporting Survivors Survivor Quotes Survivor-quotes Survivor Stories Teen Dating Violence Trafficking Transformative-approaches |

Search by typing & pressing enter

RSS Feed

RSS Feed